Ever stone puts on the block a piece of Burger King India

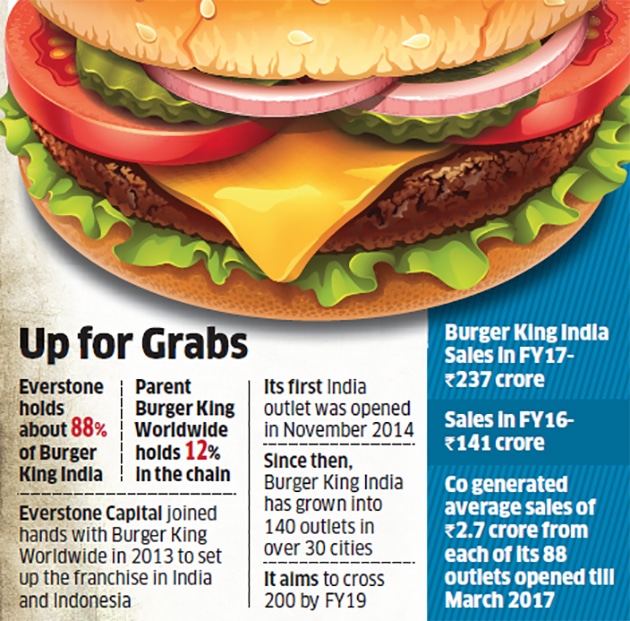

Five years after setting up the franchise for Burger King in India, homegrown PE firm Everstone Capital is set to offload a minority stake in the quick service restaurant (QSR) chain. Everstone, which holds about 88% of Burger King India, will offload 20%, valuing the chain at $300-350 million, according to two people aware of the development.

As per the proposed transaction, about 30-35% of Burger King India will be sold through secondary and primary offerings. Parent Burger King Worldwide holds 12% of Burger King India.

Advisory firm EY has been mandated to run the sale process, which is expected to be launched in a few weeks, said one of the persons cited above. Ever stone will remain the controlling stakeholder after the transaction.

F&B Asia Ventures, a pan-Asian food and beverage business platform controlled by Everstone Capital, owns and operates Burger King’s branded restaurants in India and Indonesia. Everstone joined hands with US fast-food chain Burger King Worldwide in 2013 to set up the franchise for the two countries.

Burger King India grew 68% to post sales of Rs 237 crore in FY17 from Rs 141 crore in FY16. In FY17, the company generated average sales of Rs 2.7 crore from each of its 88 outlets opened till March 2017, while rival Westlife Development, which runs McDonald’s in the south and west, posted average sales of Rs 3.6 crore from each outlet. Burger King, however, notched up higher numbers than Jubilant FoodWorksNSE -0.72 %, where average sales per outlet were at Rs 2.1 crore from both its brands, Domino’s Pizza and Dunkin’ Donuts, ET reported last year.

Since its first outlet was opened in November 2014, Burger King India has grown into 140 outlets in more than 30 cities in India and is expected to cross 200 by FY19. The chain is present in Amritsar, Ahmedabad, Bengaluru, Chandigarh, Chennai, Hyderabad, Kochi, Ludhiana, Mumbai, Delhi-National Capital Region and Pune.

If the deal materialises, it will be Everstone’s second part exit from the food and beverages (F&B) portfolio in the past year. In December, Everstone sold a stake in Massive Restaurants, owned by Jiggs Kalra and son Zorawar Kalra, to PE firm Gaja Capital.

If the deal materialises, it will be Everstone’s second part exit from the food and beverages (F&B) portfolio in the past year. In December, Everstone sold a stake in Massive Restaurants, owned by Jiggs Kalra and son Zorawar Kalra, to PE firm Gaja Capital.

Brands on its F&B Asia platform include Harry’s, Domino’s (Indonesia), Burger King, Pind Balluchi and Duck & Rice. The fund has invested over `1,200 crore in the sector so far. Besides F&B Asia, Everstone also owns Pan India Foods Solutions, a platform with brands such as Spaghetti Kitchen, Copper Chimney, Gelato Italiano, The Coffee Bean & Tea Leaf, Bombay Blue and Noodle Bar.

“Investor interest in Indian QSR is driven by the same trends that are driving consumption theme across categories such as demographics, urbanisation and eating out,” said Harminder Sahni, managing director of retail consultancy firm, Wazir Advisors. Multinationals have the advantage of global brand equity and experience. Indian brands are too young to compete as of now and have to tackle issues such as product development, supply chain, store expansion and consumer connect, Sahni added.