Future Retail may buy Hypercity from Shoppers Stop – a win-win for both buyer and seller

By acquiring Hypercity, Future Retail aims to leverage its retail capabilities by building economies of scale, reducing overall cost of operations, expanding the number of small/convenience outlets (especially in the metros), and pushing the sales of its margin-accretive private label consumer products.

Moneycontrol Research

After taking over four regional retail brands (Bharat Retail and Big Apple in north India, Heritage Fresh and Nilgiris in south India) to strengthen its store network in the past, Future Group’s agenda to expand its grocery retail footprint pan-India has led to speculation of it eyeing Hypercity, a business that hasn’t done too well under Shoppers Stop. Will it result in a win-win deal?

About Hypercity

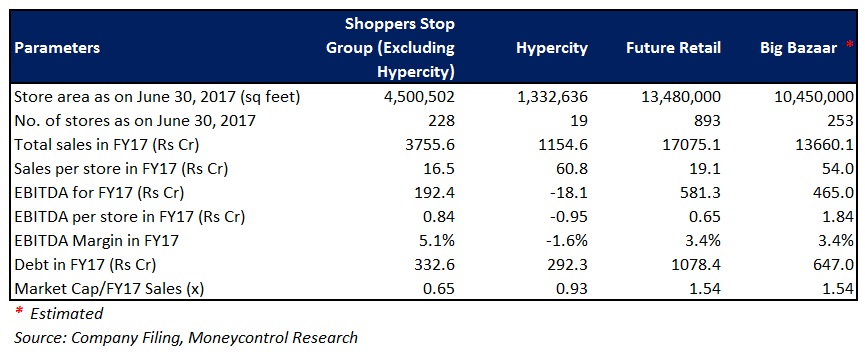

Hypercity, a subsidiary of Shoppers Stop (also co-owned by K Raheja Corp), is one of India’s most renowned supermarket retail brands. Its 19 big-box format stores span marquee locations of Mumbai, Hyderabad, and Bengaluru, Bhopal, Ludhiana, Amritsar, Jaipur, Pune, Ahmedabad, Delhi, and Noida.

About Big Bazaar

Big Bazaar, Future Retail’s flagship brand, is India’s largest organised store-based retail market, with nearly 20-25 percent market share. The brand’s 253 outlets are spread across 127 cities in 26 states of India (as on June 30, 2017).

How does Future Retail benefit?

By acquiring Hypercity, Future Retail aims to leverage its retail capabilities (by adding about 1.4 million square feet of retail space to its existing 13.8 million square feet area), building economies of scale, reducing overall cost of operations, expanding the number of small/convenience outlets (especially in the metros), and pushing the sales of its margin-accretive private label consumer products.

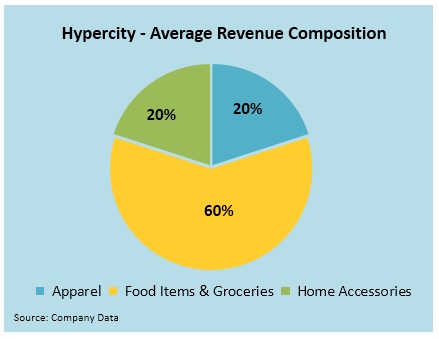

Moreover, the company is likely to shift its product mix in favour of apparel, especially on the value fashion front, to boost margins. Since there will be no gestation period in connection with the Hypercity stores (the outlets will be fully functional right away and no major capex will be required either), benefits of the takeover will start accruing to the company’s top-line almost immediately. How things pan out at the operating and bottom-line levels solely depends on how optimally the company manages to sweat the new assets under its purview post-acquisition.

Furthermore, the company’s aggressive consolidation strategy is directed at competing with efficient brands like D-Mart (operated by Avenue Supermarts), one of the bigger players in western India.

The move is in line with Future Group’s plans of achieving an aggregate turnover of approximately Rs 1 lakh crore by FY21 end.

Shoppers Stop stands to gain as well

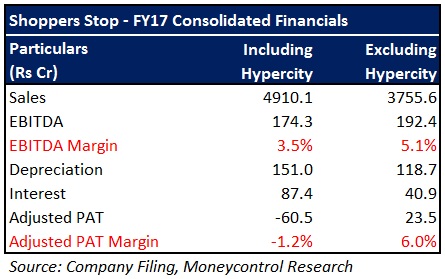

Though the contours of the agreement are far from final, prima facie, it appears to be a good deal for Shoppers Stop, too, as it gets rid of one of its loss-making business segments. This should enable the company to focus more attention on its core retail businesses (clothing, merchandise, accessories, cosmetics) that may fetch better margins in the medium to long-term.

Evidently, Shoppers Stop should definitely witness an improvement in its financials should it succeed in hiving off Hypercity.

What will the transaction value be?

The valuation is largely a function of the fundamental parameters. Given the rather subdued operating matrix of Hypercity, it is unlikely that Shoppers Stop would command a premium for this entity. We expect the deal to be valued close to 0.7x FY17 revenue, translating to a valuation of close to Rs 974 crore. However, the exact clauses of the arrangement in terms of payment of consideration by Future Retail to Shoppers Stop (by way of cash disbursements, taking Hypercity’s debt on its books, allotment of shares in Future Retail to Hypercity shareholders, or a combination of the three), will only be known in due course.